Do bright people earn more than others? If not, it would strengthen the view that intelligence tests are no more than meaningless scores on paper and pencil tests composed of arbitrary items which have no relevance to real life. So, it is with trepidation that I responded to a suggestion by a reader that I look at a paper appearing to show that there is no relationship between intellect and wealth, and furthermore that clever people are just as likely to experience financial difficulties as any other citizen.

Do you have to be smart to be rich? The impact of IQ on wealth, income and financial distress

Jay L. Zagorsky. Intelligence 35 (2007) 489–501

The abstract apparently bears out that interpretation:

How important is intelligence to financial success? Using the NLSY79, which tracks a large group of young U.S. baby boomers, this research shows that each point increase in IQ test scores raises income by between $234 and $616 per year after holding a variety of factors constant. Regression results suggest no statistically distinguishable relationship between IQ scores and wealth. Financial distress, such as problems paying bills, going bankrupt or reaching credit card limits, is related to IQ scores not linearly but instead in a quadratic relationship. This means higher IQ scores sometimes increase the probability of being in financial difficulty.

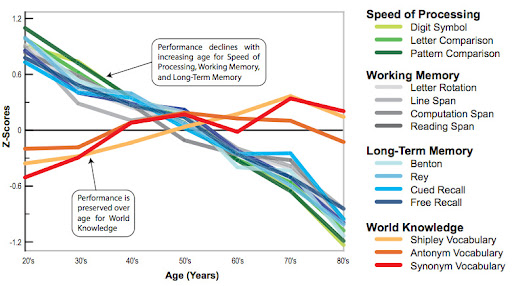

Happily, another reader, “res” had a closer look at the paper, and found that all was not as it seems in the abstract. That is to say, the results in the paper actually show a relationship between intelligence, earnings and wealth, as shown in the histogram below, which I have drawn based on the results from that very paper:

I think this shows that income gradually increases with intelligence, and wealth increases more strongly with intelligence, in a roughly linear trend. It is relevant to know that income at the lower levels of ability include welfare payments and that incomes at the very highest level have been capped for reasons of confidentiality which both reduce the real relationship between intelligence and earning power. However, the general picture is clear, and somewhat different from what the abstract suggests.

Introduction. How important is intelligence to success in life? Success is a multi-dimensional concept but one key component for many individuals is how well they do financially. It is still not well understood why some people are rich and others are poor. Previous research, discussed below, has investigated the relationship between intelligence and income and found individuals with higher IQ test scores have higher income. Income alone is not a complete measure of financial success. This research completes the picture by investigating if there is a relationship between IQ scores and wealth and if there is a relationship between IQ scores and financial difficulty. What are the differences between these three financial measures? Income is the amount of money earned each time period, such as a weekly pay check. It is the stream of money off which people live. Wealth is the difference between a person’s assets and liabilities. It is the reserve or cushion that people fall back upon to meet large expenditures, unexpected emergencies and periods when income is expected to be low. Financial difficulty is getting into a situation where a respondent’s credit is adversely impacted such as not paying bills or charging a credit card to the maximum limit. These situations prevent or reduce the ability of individuals to borrow money in the future. Financial success for most people is a combination of all three measures; having a steady income stream, a stock of wealth to buffer life’s storms, and not worrying about being close to or beyond their financial limits. Previous research has focused on intelligence’s impact on income and found a positive relationship.

The authors have given an interpretation in the abstract which does not fairly reflect what they actually found. The data plot above, taken from that paper, shows a strong relationship between intelligence, income and wealth.

Commentator “res” shows that the 2007 figures probably under-estimate the effects of intelligence. First, incomes at the lower level of intelligence are inflated by welfare payments, and those are not shown separately. That is a real problem, since it hides the lower wages actually paid to low ability workers. Second, the wages of the brightest 2% of workers have been truncated, apparently so as to protect their anonymity. Not sure how their anonymity was threatened, but it is a nuisance, since in the early years top income were artificially capped at $75,000 then later at $100,000 and finally shown as the average of that category. This is a real pity, because it obscures the incomes of the smart fraction. Though the sample size is perfectly adequate for most purposes, eminent minds are 1 in 10,000 so the sample will contain only 1 or 2 of them. It would be good to know how much they earn, and how much wealth they have.

As luck would have it, I had commented on the same dataset in 2015 and, despite a few cautionary statements, came to the conclusion that intelligence was strongly related to income, and to savings. I also established a rule-of-thumb, that when young adults are doing well financially, their savings equal 4 years of their normal annual earnings.

I should explain that the 2007 paper being referred to above was an early look at the data, and the later work a more up-to-date set of findings. Both give substantially the same pattern of results, though the actual numbers have changed somewhat, as one would expect as the subjects get older, earn more, and have more time in which to save.

https://www.unz.com/jthompson/the-wages-of-intellect/

Looking back, there is a lot to ponder in these posts by Steve Hsu. For example, it seems that for both white and black children in the NLSY dataset, progress is identical when children are considered in terms of their IQ.

Steve dryly notes:

This last figure is very problematic for the “Social Status/Wealth causes IQ” position. It seems to be the other way around: the kids escaping bottom quintile childhoods all experienced poverty, but the ones with higher cognitive ability were more likely to move up. (Recall that adopted children tend to resemble their biological parents much more than their adoptive ones; family environment has a limited effect on IQ, which is highly heritable.)

Pew: Individuals with higher test scores in adolescence are more likely to move out of the bottom quintile, and test scores can explain virtually the entire black-white mobility gap. Figure 13 plots the transition rates against percentiles of the AFQT test score distribution. The upward-sloping lines indicate that, as might be expected, individuals with higher test scores are much more likely to leave the bottom income quintile. For example, for whites, moving from the first percentile of the AFQT distribution to the median roughly doubles the likelihood from 42 percent to 81 percent. The comparable increase for blacks is even more dramatic, rising from 33 percent to 78 percent. Perhaps the most stunning finding is that once one accounts for the AFQT score, the entire racial gap in mobility is eliminated for a broad portion of the distribution. At the very bottom and in the top half of the distribution a small gap remains, but it is not statistically significant.

What other data are available?

Pumpkin Person looked at intelligence and income, and suggests that they correlate at 0.49 which is higher than most published estimates. This analysis looks at the rarity of high wealth and the stated scholastic attainment scores of some people in wealthy groups.

https://pumpkinperson.com/2016/02/11/the-incredible-correlation-between-iq-income/

Pumpkin Person notes that Dalliard in a very detailed analysis of average income over several years found that men’s average income and intelligence scores correlated at 0.48

http://humanvarieties.org/2016/01/31/iq-and-permanent-income-sizing-up-the-iq-paradox/

Dalliard argues that many of the low estimates for the correlation between intelligence and income are based on single year earning figures, and it is better to look at rolling averages over several years, and to note that very early in career and very late in career figures may be a poor reflection of overall career earnings. Better to calculate “permanent” earnings of the sort achieved between ages 25 and 55. He looks at NLSY79 data, wisely taking only earnings and wages (no welfare payments). Wages above the cutoff are set to the average of all wages above the cutoff. Using a log transform he shows that one additional IQ point predicts a 2.5% boost in income. The standardized effect size, or correlation, is 0.36 and the R squared is 13%.

Men’s income is more strongly related to intelligence:

For example, the expected permanent annual income of a man with an IQ of 100 is e^(8.004 + 0.027 * 100), or $44,530. The expected permanent annual income of a woman with the same IQ is e^(8.004 + 0.021 * 100), or $24,440.

Below, income by racial group, which should be compared with group differences in intelligence, with which there are close parallels.

Looking at how to predict the effect of intelligence on each racial group, and interesting finding emerges:

Black men have a significantly lower intercept and a significantly higher slope coefficient: each additional IQ point predicts 3.6% (95% CI: 2.6%-4.5%) more income for black men.

This suggests that employers value intelligence, and pay higher wages for all brighter employees, an effect which is bigger in a group with a lower average ability level.

The OECD studied the intelligence and income link in a roundabout way, because these researchers appear not to believe in intelligence and intelligence testing.

https://www.unz.com/jthompson/how-illiterate-is-oecd/

You will see that I was irritated that they would not mention the fact that some people are brighter than others.

The median hourly wage of workers who can make complex inferences and evaluate subtle truth claims or arguments in written texts is more than 60% higher than for workers who can, at best, read relatively short texts to locate a single piece of information. Those with low literacy skills are also more than twice as likely to be unemployed.

“Across the countries involved in the study, between 4.9% and 27.7% of adults are proficient at the lowest levels in literacy and 8.1% to 31.7% are proficient at the lowest levels in numeracy. At these levels, adults can regularly complete tasks that involve very few steps, limited amounts of information presented in familiar contexts with little distracting information present, and that involve basic cognitive operations, such as locating a single piece of information in a text or performing basic arithmetic operations, but have difficulty with more complex tasks.”

The report contains descriptions of skill levels, and that is a good thing. Skills make sense, and if you say that someone has the skill to drive a car, but not the skill to service a car, (another Gottfredson quip) that immediately makes sense to most people. We can distinguish between a driver and a mechanic. We can also understand that someone who can only handle one concept at a time should not be given the task of integrating disparate conceptual inputs. That cuts out being in the control room of most industrial processes. In does not preclude employment as a university teacher, where to manage one concept may lead to a successful career.

Another approach to the relationship between intelligence and life outcomes is to do a birth cohort study and starting examining children at age 3.

The Dunedin study has calculated the cost to society of the most demanding section of the population. 20% of the population account for 80% of the social costs. Low intelligence is an important aspect of this needy section of the population.

https://www.unz.com/jthompson/are-you-nuisance/

Here is a more up to date paper on their work

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5505663/

A segment comprising one-fifth [20%] of the cohort accounted for 36% of the cohort’s injury insurance-claims; 40% of excess obese-kilograms; 54% of cigarettes smoked; 57% of hospital nights; 66% of welfare benefits; 77% of fatherless childrearing; 78% of prescription fills; and 81% of criminal convictions.

Childhood risks, including poor age-three brain health, predicted this segment with large effect sizes.

IQ is a strong factor, as is low self control.

You can also look at this from a States level (in the United States), and you will know roughly how wealthy those states are.

https://www.unz.com/jthompson/your-google-iq/

There are other studies which could be added, and more detail which can be explained in each of these sources, but I have picked a selection of studies to make a general point: I think it is pretty clear that intelligence has real-world implications.

RSS

RSS

Capping “top income” to $100k is (as you note) a ridiculous truncation of the data set. Anyone who actually uses a 120-plus IQ in their occupation sails massively higher than this (for example, engineers or computer scientists easily start their careers not that far from this, and if they’re remotely capable surpass it long before they turn 30.)

By cutting off the data there, any study basically removes the effect of IQ’s much above the median for college grads. It washes out the “benefit” of an occupation in medicine, law, engineering, comp. sci., or even success in business (e.g., a sales career in science, medicine or similar industry.) Even doing so, this still shows a marked effect of rising intelligence on wealth and income.

I so tire of those who enjoy the fruits given them by those who are brighter, yet they resent their capability and seek every opportunity to rationalize their envy by claiming wealth and income are somehow just a game of chance.

PS: The greater payoff for blacks with higher/rising IQ’s simply reflects Diversity, Inc’s higher demand curve for the smart fraction. Affirmative Action and de facto quotas make a black with a 115 IQ probably ten times more “valuable” to a major corporation than a white (especially a straight white male) with similar intelligence. To say there’s a perpetual bidding war among the Fortune 500 for the few capable blacks is a profound understatement. Derbyshire was correct, to be an intelligent, well-socialized black today is height of felicity; you’re in demand by all “right thinking people.”

PPS: I wish there were good data on the benefit of IQ’s above 140. My anecdotal experience suggests that success among the very highly intelligent is bimodal. https://polymatharchives.blogspot.com/2015/01/the-inappropriately-excluded.html

I thought Charles Murray went over this subject quite exhaustively in “The Bell Curve”. When I read it I thought that his observations made statistical sense and tied in well with what is commonly seen in day to day life.

Zagorsky’s claim that

has me scratching my head. What is he alluding to? Possibly the Trump phenomenon where a rich person can go spectacularly broke and then get spectacularly rich again.

Looking for a link between intelligence and wealth, as if it’s absence would indicate the invalidity of the idea of intelligence?

Now, that’s just stupid.

He just means the curve is U shaped. Higher rates of distress for the lowest and highest IQs and lower in the middle. I criticized those results in the other thread because the paper used a cubic fit (i.e. likely to go to +/- infinity at the extremes) for the variables and then evaluated the equations at IQ 140+ while the actual data appears only to go up to IQ 125.

Definitely an issue, but recall that the dollar value truncations were happening in the 80s and early 90s (IIRC) when those salaries were a bit less common.

Indeed.

At the same time, the game of chance component is important at the individual level. Despite the strong group (IQ cohort) trends shown, IQ explains surprisingly little variance in the data.

There is. The SMPY (aka “Lubinski and Benbow”). Searching for SMPY at Steve Hsu’s blog infoproc.blogspot.com gives a good introduction to the voluminous literature https://www.gwern.net/SMPY

I read your post years ago and found it very interesting. It seems to have picked up more comments since then. Reconciling the two sets of observations (SMPY and your/Grady Towers/etc.) is an interesting problem. Many analyses forget exactly how rare those high IQ people are (since IQ is not the only important success trait and luck matters, proportion in the population is key). Your analysis gets that more right than most, but I am not sure how important the ideality (Gaussian) assumptions in “By dividing the distribution function of the elite professions’ IQ by that of the general population, we can calculate the relative probability that a person of any given IQ will enter and remain in an intellectually elite profession” are.

I think Simonton’s 20 point observation is a big part of what we see (as you rightly discuss). Along with high IQ individuals having traits that cause issues at a rate not that different from the rest of the population. How many IQ 115 people fail to achieve their potential? Are the 140+ failures that much more common, or just more noticeable because of the additional potential squandered?

Thanks for the thorough post, Dr. Thompson. I need to spend some more time on it, but one thing caught my eye on the initial read.

If I understand correctly, the final table has a mix of discrete and continuous variables. From the paper figure caption.

This indicates to me that, despite the smaller coefficient in the multivariate model, low self-control is more important than maltreatment. This is because maltreatment only varies from 0-2 giving a maximum RR of 1.31^2 = 1.72 while self-control varies (conservatively, this is the 95% interval) from -2 to +2 giving a maximum RR of 1.24^4 = 2.36

It is interesting to observe how the self-control multivariate model coefficients vary across the outcomes. It is highest for crime at 1.26 (which seems intuitive), but lowest for obesity at 1.04 (which seems non-intuitive to me).

In 2014 I was told, by either Terrie Moffitt or more probably Avshalom Caspi, in answer to a conference question, that the informal assessment of self-control at age 3 was one of the best, possibly the quicket and best predictor of later life outcomes. That is to say there was a formal “neuro-psychological” assessment with tests and observations, and then a short additional piece about what the child was like to test. Some item like “could not concentrate” or “impossible to test properly” turned out to be an excellent indicator.

In child psychiatry we had a similar concept, officially “uncooperative with testing” but informally “impossible to get settled”. Usually this could be diagnosed on entering the waiting room: the Mum would be exhausted, and the child would be bouncing about, repeatedly playing with the door handles, and knocking to doors to and fro.

Do you have any sense of the relationship of self-control to time preference? The marshmallow test conflates the two to some degree, but I think there is a useful distinction to be made. I wonder how the quadrants would populate for:

1. Binary question would you prefer one marshmallow now or two in fifteen minutes?

2. Binary can child wait fifteen minutes for n (chosen so child thinks it is worth it to wait, intellectually) marshmallows with one sitting in front of them?

How relevant is numerical waiting time vs. binary able to wait?

Any thoughts on children who were “hyper” but could focus when confronted with something interesting? Any resemblance to me is strictly coincidental, of course ; )

P.S. I also need to spend some time looking at the Supplemental Material for Caspi et al. 2016.

claiming wealth and income are somehow just a game of chance.

They are in part a game of chance – what aspect of life is not?

It’s the just that’s wrong. It would be as daft as claiming that wealth and income are just a matter of IQ.

That cuts out being in the control room of most industrial processes. In does not preclude employment as a university teacher, where to manage one concept may lead to a successful career.

I once knew a chap whose successful career seemed to be based entirely on the happy fluke of having had two extremely good research students in his early years. I never did work out how those two lads had managed to put up with him. Benign neglect, perhaps.

I was irritated that they would not mention the fact that some people are brighter than others.

Such people are much more irritating even than the lummoxes who persuade themselves that only IQ matters in life. More irritating, I suppose, because everything in their actions in life says that they are lying rather than being “wilfully blind”.

The mashmallow test must be wrong. A castaway on a raft has a bottle of water: Should he drink it all now or ration it? A prisioner in the gulag chances to posess a whole piece of bread: Divide it up so it lasts a week or is it better to wolf it down now? As all hunting animals in the savannah, the most rational strategy is to eat all one can now. Ergo, the evolutionarily correct behavior is to eat it now and not to take chances with some psychologist’s promises. Mas vale pajaro en mano que cien volando, as we say in the ghetto.

At least 1/3 of the rich inherit their money. Not discussed here. Invalidates your whole tranche of damned lies. I mean statistics. And I don’t think counting the higher salaries of autistic idiot savants who bean-count well on behalf of real actual rich people is really playing fair either.

Anecdotally this is a description of the difference between two of my kids. At 3 one was all over, the other quiet and studious. Both are unusually successful, working for major corporations (STEM occupations.) While neither has formal IQ test results, the studious one only once received less than an “A” all the way K through college and the “restless” one finished college at 20, so they’re fairly rare.

Is it possible that “difficult to assess” could put the restless-due-to-boredom and the restless-due-to-inability in the same bucket? The latter would surely be an early indicator of future hard times.

Lots of 140-plus IQ people enjoy but modest income and wealth. Must we repeat the obvious?

The debate over hard work vs luck is a very dangerous one; I see lots of low-aptitude (or lazy) people emphasize luck as a means of justifying robbing the successful of the fruits of their labor (also known as taxing the hell out of the 20% of the population that already accounts for most of today’s tax payments.) I’m not a fan of this; those who over-emphasize the “luck” component as a rationalization for their parasitism are no better than tapeworms.

Prof Thompson:

A Question. Is Zagosky’s wrongheadedness due to his being a fool or a knave?

You seem to reject the importance of luck not any grounds of evidence but on the grounds that you disapprove of the uses to which the observation might be put. That’s an interesting strain of anti-science: it’s much the same argument used by anti-HBDers.

Having founded a quant hedge fund and worked and known with some very smart people -2 gold mathematics Olympiads, a few math prodigies and an army of at least 135 IQ guys based on APM-

And also having the opportunity to have known and interacted with some very rich people and billionaires either through work or hobbies ( clients and being a top 100 ferrari client)

I am in the unique position to observe that the relationship between income, wealth and IQ breaks down at the top 0.1% percentile. I pay and get paid by these people so I know…

The very rich would be around 120-130 IQ. I have not seen anyone who have strike me as brilliant.

It’s really a sad state that the high IQ are only interested in using their IQ to pursue wealth. The #1 career for MIT physics majors is probably as a Wall Street quant. What a waste of talent. How about doing theoretical physics and other scientific research to help understand the universe, explore space, build solar powered flying cars, etc. etc.?

How many geniuses died broke?

A black with 115 would be 10 times more valuable than an East Asian and 6.6 times more than a white person.

The limit of this line of reasoning is that he would be 15 to 20 times more valuable than a Jew (depending if their average IQ is 110 or 115) and it doesn’t look that way to me ….

The cap is a problem no doubt about it. However, the entire system has too much “noise” in the data. First of all how did the people in these so called studies obtain their money and net worth? The rich and super rich inherit their bucks…is that part of the data field. How is the wealth determined? This is like those who try to match IQ with GDP etc. of countries of the world. Countries like Italy have an underground economy that is probably upwards of 40%.

I know people who are basically middle class farmers but own an enormous amount of land next to their farms. This is mountain land but what will it be worth in the future? Many of the rich in this country make their money on the borders of legality or illegality depending upon which side of the fence you are on. Jews use a massive network for their wealth. Does that count?

Plumbers today can make more money than most college professors. Plumbers are pretty smart but I doubt they could do heavy scientific work. Are we to determine that IQ of the professors don’t help them because they have chosen a life in academia and like that life style?

Some people don’t care to chase the crowd in terms of money….no matter how smart they are. The higher IQ obviously gives people more opportunity to make money but it doesn’t guarantee it. As I have said…there’s a lot of noise in any data about this type of stuff and it won’t be settled by regression analysis or any other mathematical paper because anyone could take a specific subset of any of the data and run something on it and get exactly what they want. In fact, Taleb pulls stuff like this all of the time in his magic papers by controlling the context by playing with averages and subsets.

Buffett has allegedly a 155 IQ. Gates is probably above 150. Same for Google founders. D Shaw, the hedge fund founder is probably above 160.

Thoss people are far above the 0.1% in income (600k) and wealth and IQ (148).

1% household income : 386k

0.1% : 600k

0.01%: 1600k

0,001% : 7500k

https://review.chicagobooth.edu/economics/2017/article/never-mind-1-percent-lets-talk-about-001-percent

So in terms of revenue, there is a big acceleration around 1 in 1000k . Not 1 in 1k. If correlation were 0,5 with intelligence the threshold would be 130 or Mensa level to get that high. Meaning only 1 in 2500 people that intelligent would make it that high in revenue. It doesn’t look irrealistic.

There is no logical reason to think the correlation breaks up anywhere except the « feel good » necessity of clever people who doesn’t succeed as much as they wanted to and find convenient psychological excuses for that …. when they could just think they have a higher purpose and interest, thinking tall like some public characters

Household income level

IQ average IQ threshold for a correlation of 0,5

Probability to get there is you have just the threshold IQ needed

10% : 150k. 110 40%

1% : 386k. 118. 8%

0.1% : 600k. 124. 2%

0.01%: 1600k. 127. 0,3%

0,001% : 7500k. 130. 0,075%

So with a linear correlation between IQ and income of 0,5, you would still have this feeling that intelligence doesn’t bring you were you « belong » ….

No need to invent a break-up to feel good . A correlation of 0,5 means intelligence explains only 25% of the variation in success ….

And at the next level, it looks like the 1 in 1000k in income (100 richest household) is above 150M a year. Average threshold would be 136. And there, the 115 people who inherits or’marry their wealth would cancel out the 150+ people who created it.

0,5 seems a reasonable correlation . But then intelligence explains only 25% of income variation. And it’s prettt straightforward to reach 150k of household income but above that, even if the correlation stays the same, the subjective relational becomes very loose.

If you are in the 10% more intelligent, you have 10 times more chances to belong to the top 1% in income than the average guys. But the odds are still 10 to 1 against you. Some would be satisfied only if their chances were close to 10%. But with reasoning,, IQ fanatics would like your chances of being 0% 🙂

A lot of these studies are dated and irrelevant to the current generation. When you figure in things like grievance-mongering feminists, affirmative action, and very deliberate anti-white and anti-male propaganda so obviously intended to sabotage white males into NEET porn-addicts and incel losers, then I doubt that correlation still holds. Universities today do not reward or value intelligence, creativity, or initiative. What they value and reward is rote learning, obedience, towing the liberal party line and actively and passively discriminating agaist white males at every possible opportunity. The white males who make it through to the end are the most cucked and effeminate specimens you could possibly imagine. It is horrific to see. Now the bizarre society we live in makes sense. As above so below. No wonder white girls love black cock so much: it’s not a pathology, but a natural and healthy reaction to being surrounded by such weak and utterly cowardly “men”. And these results are by (((design))).

I read this to my wife who is a child therapist and she agreed right away.

It figures, does it not, that thresholds are important, whether for IQ type intelligence, conscientiousness or ability (physically and by organisation of one’s life) to give concentrated time to the job and that when you consider how many of the very rich have made their wealth or kept and grown it in real estate an IQ of 120 to 130 should usually suffice. (I can remember many meetings during years at one occupation where I would look at some figures or words and come up quickly with the errors no one else had seen but apart from people being happy for me to chair some committees or give a private report to the top banana it was by no means critically beneficial. That I am prosperous enough to risk little by playing unproductively in the UR sandpit has something to do with the ability to assess opportunities and avoid mistakes using an independent mind but much more to do with the good fortune to be Australian while huge mineral resources are developed, Japan’s then China’s demand for our exports has soared and our big cities have grown fast. Yes, I haven’t yet cashed in on the farmland I bought with a realistic – intelligent? – view that I didn’t trust myself to be a farm manager so the land had better be close to a major city where the odds were on it increasing rather than declining in real estate value….)

Apologies if my question is way off beam but your last paragraph made me think of some fairly convincing stuff I have seen or heard recently about the obesity epidemic. Apparently its all about fructose since the beginning in the late 60s of the use of cheap corn syrup. (I haven’t got quite clear in my mind where sucrose comes in because the YouTube presentation by Dr Jason Fung that I gave some attention to, did seem to indict sugar too. My attention was mostly directed to getting support for my prejudice in favour of intermittent fasting and finding out which régime would be best for my perpetual life program. Further to digress: I am pleased to believe that cutting down one’s calorie intake by fasting makes double sense because it not only defends against the metabolic syndrome but does not diminish one’s rate of metabolism). I’m not sure why obesity wouldn’t still correlate highly with the feckless lower orders who want their sugar fix and want it cheap but maybe that’s because the higher quintiles haven’t yet had enough time (or hadn’t by the time the stats were compiled) to work out how to deal with the craving for sweetness.

Assume I am very tired from conscientious activity, or hyperactively distracted if you must, but don’t make me work out what those figures just above the word “DIFFERENCE” are in your third graph. Excuse, my eyes are tired from workingvwith very small screen. Further elucidation please.

Viewing intelligence in relation to income/wealth reveals just the utter view, that some think “money”, in reality a debt, would constitute something natural. Its a greedy system, and the most ruthless and unethical earn the most in the system.

Income is basically an arbitrarily assigned number of debt for a job, if you put it all in relation to the debt system that is being run, the FED, ECB, BoE etc.

All the statistics that put intelligence in relation to income say nothing at all about intelligence. I may say something about those who collect the data and compile the statistics, the circus must go on, right?

The most unethical earn millions, but the most intelligent try to not be part of the system.

I don’t see Soros, Adelson as overly intelligent, rather than criminal, which requires a special type of “intelligence”.

Example,the inventors of some tool usually die poor, while those who market the invention or stole it, die rich.

You really think Zuckerberg can write even one line of code? Think again, he can’t, he is unable to do so, he has proved it.

PS The boyfriend of a close female relation kindly arranged a special presentation for me of a computerised trading system since I had been otherwise detained. It was a father and son outfit with the son the actual mathematician. His father gave the slide show presentation. At one point, being the only person there who wasn’t part of the sales effort, I said “would you mind going back to the last slide and tell if the numerator and denominator haven’t been switched in that formula at the end of the middle paragraph”. I was right. And apparently no one amongst the hundreds who’d seen the presentation had drawn attentiin to the error.

Now that’s not an idle boasting war story because it prompts a worthwhile question in my mind about what the psycho-social preconditions are for someone behaving as I did. I did not come from a Confucian excessive-respect-for-one’s-seniors background. I was the only child of a very bright though not educated mother and never told to pull my head in. My school contemporaries included future full professors, university presidents and senior judges who, sometimes I get evidence remember me as the quickest to get a translation right or solve a problem, as well as being the youngest. But, but…. supposing I had been like Puzhong Yao whose story Godfree Roberts recently introduced UR readers to? Clever enough to get First Class Honours in Mathematics at Trinity College, Cambridge, but not confident that he would go on being a star if he stayed the Chinese course towards Beijing University with hundreds of brilliant contemporaries. It makes one wonder how many great developments in science and technology there have been from the diversion of clever conscientious original minds away from the Ivies, MIT, Caltech and Stanford to humbler universities and institutes where they blossom with never a nagging thought that they are really not smart enough.

Are self-control and conscientiousness the same for the purpose of determimg whether someone has, when IQ is also assessed, the makings of great achievement? Can you point to – and a big ask: summarise – the literature on their measurement and significance? Also on their heritability and what is known about the relevant genes?

Clearly some “short sleepers” have a valuable characteristic for becoming high achievers too. I have only just, at long last, found the ABC’ Radio National’s Health Report state the obvious, viz. that requirement for sleep is a function of many genes and normally distributed. Can you add flesh to that? Is there a better combination of genetically influenced factors to exolain success in life than IQ + conscientiousness/self-control + need for sleep?

Amazing what fun taking the abacus into sandpit isn’t it? 🙂

😎

The way I see it, intelligence has nothing to do with making money!

Well, it’s certainly an inconvenient one (for you).

Since you’re already on record as claiming that your wealth is largely a result of your high IQ, it’s worth pausing to ask just what you did to “earn” that high IQ. Because as far as I can tell, it was just a matter of chance.

As for inheritance, that is clearly the ultimate in unearned wealth.

I believe that generally more equal societies are more pleasant societies, so you can rest assured that I will support redistributing some of the rewards from those who largely earned them by virtue of dumb luck, to those who found themselves in no position to ever earn much, again largely by virtue of dumb luck. (It would be prudent, of course, to restrict the genetic proliferation of the latter group.)

One way would simply be to tax inheritance at 100%. Since that would run into serious compliance issues, a simpler method is to simply tax people as we go. Fortunately, such a system is already in place.

This must be perplexing to hear, but you can always comfort yourself with the reminder that at least the howling mobs are coming for your wallet rather than your neck.

Sorry, I had some trouble with the images, since sorted out. Here is the explanation which I ommitted so that the actual graph would be bigger, and in better focus.

Superior cognitive ability is strongly indicative of upward mobility from the lowest quintile. This is true for both blacks and whites. Individuals who are cognitively at the median in the overall population have an 80% chance of moving up and out of the bottom quintile. What does that say about those that remain in the bottom quintile?

About the Dunedin sample results?

Interesting how White people are all tied up in the idea of IQ when the only thing that really matters to White people is race and how good a marksman they are.

Thanks. What I was seeking to understand was what the figures were along the horizontal axis above the word “DIFFERENCE”. What do they measire/signify, and how?

Have you ever tried to think of inheritance taxes as defeating the aims of those who save and invest and start new business with a view to having certain effects in future, even beyond their lifetimes**, rather than as taking unearned wealth from inheritors? Therefore as a tax on the present generation of savers?

**to forestall half-baked expostulations about the iniquity of those who seek to affect the world after their deaths let me just invite thought, in the short term to supporting the widows and children of those who die young and, in the longer term, to work to preserve endangered species, heritage buildings and the like.

Where is Part 1 of The Wages of Intellect?

The probability of moving out of the bottom, poorest, quintile

Astonished, non-expert and supportive reader of Prof. Thompson’s good contributions here.

I read Michael W. Ferguson’s “The Inappropriately Excluded” at the polymatharchives to which you linked. I suggest this provocative and outright troubling article to anyone reading here.

I agree with the comments here that contend there’s a lot more connected with income and net worth than IQ. But, as I’ve said before, we’re going to judge “brightness” or “cleverness”, “dullness” and “obtuseness” anyway, so I’m in favor of scientific inquiry to sharpen our perceptions.

How about doing theoretical physics … to help understand the universe?

Fundamental physics has been stuck since the seventies. The top exciting science nowadays is genetics and its kindred subjects.

Macadamia nutteries! Those were fashionable investments when we first lived in Oz. How did it all turn out for the doctors, dentists, and so on who ventured their capital?

What’s with the net worth dip at 110 IQ?

Are there any tests at age 1 or 2 which are predictive? I’ve looked to see if there is anything predictive about early milestones – crawling, walking, talking – and the data is a bit too messy to be useful.

https://www.unz.com/jthompson/the-wages-of-intellect/

https://www.unz.com/jthompson/the-wages-of-intellect/

It was in the text above.

Thing is, what should be done to take care of the problem?

Loads. Tesla springs to mind.

It’s not a discussion I’m interested in. Progressive taxation is here and it’s not going anywhere, nor should it.

Have you read or even heard of Helmut Schoek’s fascinating book on Envy? Very much worth reading.

Let me guess. You have never made much money?

Thank you. You will obviously forgive me the fact that it didn’t spring to mind as in your text 🙂

It is odd that I coildn’t find it by clicking on your name to see all your UR articles.

Agree increased dietary fructose is probably important, but I doubt it is the sole issue. Intermittent fasting seems like a useful idea. I don’t do it much, but find it useful when I feel myself getting a little sick. Seems to work as a bit of a body reset.

One of my pet theories about the obesity epidemic is it is partly caused by the body trying to satisfy micronutrient deficiencies caused by poor food quality and/or choices.

In Table 1 there are small (not or barely significant) multivariate correlations for obesity with childhood low SES and IQ, but the self-control RR was essentially 1. I found that surprising given that one would expect it to correlate with ability to adhere to a diet or exercise program.

My guess is statistical noise. Disproportionate number of wealthy outliers in the 105 group. If I ever get around to downloading the data for myself I plan on taking a look at that.

Thanks for the recommendation.

Great reply Anon[617] ! 😂

“Austrians” who think von Mises or Rothbard said the last word on economic matters are in enough trouble. People who pick up some garbled nonsense from the Austrians which they allow to completely confuse them haven’t a hope of making sense. And your reference to the money paid as income being debt shows you really stuck in an intellectual mire when it is actually very simple.

The only way you could justify what you say about income being an arbitrarily asdigned “number of debt” for a job is to make something out of the fact that some currencies, even on the bank notes, are ore used to be expressed as promises to pay on demand. (Yes, you may yearn for the day when the holder of $35 in US bank notes was owed an ounce of gold). Even so your “arbitrarily is ridiculous because, however arbitrary a pegged gold or gold exchange standard may be, the amount of the currency promised and paid to the worker or shareholder is not arbitrary but a matter of agreement (or arbitral award or law) and contract.

Very small point: ability to adhere to an exercise program would be correlated but not directly relevant because exercise burns far too few calories for weight control. (I guess its greatest effect might be in suppressing appetite when done very hard just before meal time – and maybe improving morale)..

Unless you propose to quite literally burn a person’s wealth when they’re cremated, someone is going to get whatever is “left over.”

Are you so much the sophist that you think electing a ruler who will put that wealth into service to you (generally rationalized by genuflection to some vague notion of “society” as a real entity) makes it “earned” to you? That you think you (personally, or in some high-sounding Newspeak) are more entitled to wealth I produce than are my kids is…interesting. I suppose you’d like to prevent me from raising my kids better than you would yours, because…it’s unfair to you?

I don’t worry much about all this. If I had to transfer title of my property to my heirs before my death in order to “cheat” clowns like you, I’d happily do so. In fact, I’d personally burn it before I’d imagine you benefiting from anything you didn’t BUY from me.

Leftist loons like you are a dime a dozen in this age where people have no notion whatsoever of from where our Jetson’s lifestyles come.

I don’t reject the importance of luck. I do object to it being used as a rationalization for society-wide theft.

Your view is common, as is the cognitive process by which you arrived at it.

While we’re at it, let me just note that those who somehow “object” to a man’s “luck” in his parentage bother me on an existential level. My aptitudes are mine, they are not extricable, taxable, and I cannot be robbed of them without killing me. The same applies to the “luck” my kids had at being born quite talented. Should they have to carry louts like you as well as raise their own families? Or should others have been placed ahead of my “lucky-in-DNA” kids, affirmative-action like, to do a This Perfect Day handicap on them?

What do you think I think about those whose comments sound like they believe the outcome of that “luck” should somehow be undone? Do you realize just how parallel this sounds to those who, under Lenin and then Stalin, piled human corpses by the millions?

Yes, that’s the basket into which I place comments like yours.

No one questions that the acquisition of wealth in large amounts generally depends on the ability to acquire and use information, i.e., on intelligence as the dictionary defines that term.

What has been questioned is (a) how closely intelligence is related to income and wealth, and (b) how useful IQ test measurements are as a measure of intelligence. The data suggest that the answer to both questions is “not much.”

Looking again at Zagorsky’s figure we see, in answer to the first question, that whatever relation exists between income and wealth, the variance is enormous, and indeed over the range of data shown in the figure only two or three percent of the variation in wealth is attributable to variation in IQ.

That, however, is true only of the population investigated. One would expect an entirely different relationship in, say, a future crowded world where a Global Government imposed an existence charge that would increase with age such that, over a certain age, only billionaires could afford to pay. In that case, assuming euthanasia was the penalty for non-payment, there would surely be a very much tighter relationship than under present conditions in the West between the ability to acquire and use information on the one hand and the getting of money on the other hand.

As it is, at least in the Western world, where a universal basic income is already provided in some jurisdictions, there is hardly any necessity for anyone to apply any thought at all to the acquisition of wealth. Since intelligent people often have much better things to think about, it is inevitable therefore that many of them finish up in relatively low paying professions such as teaching, nursing, and raising kids.

As for whether IQ is a good measure of intelligence, the Flynn effect, the billionaire athlete and the idiot savant all testify to its limitations.

I think people seek answers to questions, hoping for a cookbook recipe by which to understand infinite reality.

The world, sadly, is full of questions that cannot be answered. Most of the easy stuff was already elucidated, and what’s left ends up being an endless argument about premises and controls.

As to the linked essay, I’d retitle it The Unfortunately Excluded. But success in business/finance is a lot like success with the opposite sex (i.e., finding a good mate/partner.) Neither can be reduced to a number.

Ah, but just HOW progressive?

I laugh at this. The world today is unstable, and seems likely to head into a period of rapid change and/or turnover. Given that relatively few people in the USA pay income taxes any more, but all citizens are entitled to vote, suggests that we’re already on track to eventually collapse the system.

Everything that has a beginning has an end.

From Table 1 in Zagorski

IQ correlation with Income 0.30. (also see Fig. 1 )

IQ correlation with Net Worth 0.16. (also see Fig. 1 for scatter)

Note that correlations with Education (0.32 and 0.17) are virtually identical to correlations with IQ.

Note that results correlate similarly (0.28 and 0.16) with dollars spent on food.

Sample size: N=7403

https://www.gwern.net/docs/iq/2007-zagorsky.pdf

So – DaSmartest people must be government employees – just by comparing their pensions to DaDeplorables, eh!🐺

My son with a 160+ IQ is only interested in physics, philosophy and classical music, though he aces every subject in school, seemingly without breaking a sweat. He disdains dishonesty and money worshipping, and is wary of the direction technology is headed — he thinks AI will be used more and more for sinister purposes. As a high schooler, he is culturally and economically conservative because he is highly logical; leftism which runs on emotions does not make much logical sense to him. It makes him rare among his peers, esp. since we live in the uber liberal left coast. He is often the only kid who stands up and recites the pledge of allegiance in class.

People of exceptionally high intelligence tend to have an acute sense of fairness and morality. Most of them end up becoming STEM academics or researchers, not particularly wealthy. Those who became incredibly wealthy usually are in the IQ 120-136 range, that’s why IQ 125 is often called the “optimal” level of IQ, because we live in a society where money trumps all.

IQ 125 = optimal: smart enough to rip people off, not smart enough to feel guilty about it.

More true today than, say, before the passage of the Civil Rights Act of ’64 and the executive order authorizing AA.

I would have to say that I did not feel intellectually intimidated by a single supervisor who I answered to in the 30+ years I worked for the federal government, and they were all paid considerably more than me.

When the government mandates that a member of a minority or a woman be given unnaturally higher priority in advancement to managerial positions or higher grade positions, outcomes are always going to be skewed.

In terms of Darwinian fitness, the optimum value for any organismal trait tends to be around the mean. I suspect, therefore, that for humans, at least until recently, an IQ of 100 or less was optimal.

High analytical intelligence is a fascinating trait, but it can be a cause of difficulty in social adaptation. I wish your son every success in finding a rewarding social and economic niche.

And morality may have more to do with income and wealth accumulation than intelligence:

How Money Affects Morality

Today’s obsession with wealth accumulation is a fad, nothing more.

We exist in a cesspool of fads so long-lived that they appear permanent.

When the credit bubble eventually pops we’ll see just how important to a man’s life is his beloved Harley Hog, his bass boat or his 90′ yacht. They won’t be worth even scrapping.

Human history is cyclical. We have climbed this part of the cycle higher and longer than any prior iteration, but it’s like a carnival ride: the plunge ahead (in speed and depth) is dictated by the climb we apparently have not yet completed.

FWIW, lots of people retire when they “have enough.” It’s sample selection bias to look at the people with their yachts, fast cars, celebrity, etc., and assume that all the rats are running in the same direction.

I intend to ask my grandkids, at about 12 years of age, “What life do you wish to live, the Common Life (marriage, family, work, grandkids, etc.) or the Uncommon Life (CEO, fame, celebrity, transcendent wealth, etc.?”) It’s perhaps a more-important question to answer that early than is “what do you want to be when you grow up?”

It occurs to me to ask:

Dearieme and Silviosilver, just why are you so envious?

I don’t much care about the people who have “more” than I do. I respect those who are smarter, or more entrepreneurial, or harder-working. I don’t see what they have as coming at my expense.

What about you?

[It] does not preclude employment as a university teacher, where to manage one concept may lead to a successful career.

Gold

People of high intelligence suffer the same pitfalls as everyone else. Paraphrasing Kahneman (Thinking Fast and Slow) we ALL tend to fall in love with our ideas, and bright people tend to be even worse at this.

Another: We tend to be very poor judges of our own cognition. (I think the first part of his book is very worthwhile, especially for bright people.)

The limits of intelligence and of knowledge are important. I wish I had understood that about 40 years before I learned it.

One warning: High IQ does not correlate, in my experience, with “better logic” WRT politics, economics, etc. Association with a so-called High IQ society (140 or higher, which is ten times more selective as MENSA) was like a bucket of cold water on my head. The group was full of hard left loons. One of the most active members was a Kleinfelters Syndrome zealot of transgenderism’s insanity. Talk about a non sequitur that supposedly bright people could not see.

IQ is normally distributed as you have demonstrated.

Wealth and income distributions, However, are leptokurtic and fat tailed.

I think it is fair to question whether some of the assumptions underlying correlations like normality and linearity are violated at the tails given the effects of compounding and inheritance on wealth and income.

IQ decline rapidly with age after 50 ( or is it 60?) . Warren buffet and Bill gates’s IQ now will likely be less than 130 when normed against a 25 year old cohort, yet, they had made most of their money when they at their dumbest in their life.

Just the lottery winners will totally screw up the correlation at the tails.

We are both relying on anecdotes with no empirical data so I think it will be hard to come to a conclusion. I am not a mathematician or statistician so may be I am out of my depth here.

I can assure you there is no “feel good” confounders since I myself is an outliner given my relatively low IQ. My own experience is that the amount of financial leverage a person use, compounding and his personal network have the most impact on wealth above 3 standard deviation, may explain more than 50% of variance.

Your view is common, as is the cognitive process by which you arrived at it.

Which view do you refer to? And which cognitive process?

Dearieme … just why are you so envious?

I’m not envious. Indeed, if Dr T doesn’t object, let me expand on that. I’m not envious, you cretin.

There are certainly a lot of highly intelligent people who are exceedingly arrogant — esp. among Jews. It is usually when high intelligence is coupled with narcissism, which is a common trait among Jews. Gentiles of high intelligence tend to look outward, curious at all things out there, while Jews of all intelligence levels tend to look inward, obsessed with their own intelligence and feelings. The higher IQ they are, the more narcissistic they become. I don’t know if it’s a cultural thing or a certain Jewish gene. Christianity prizes modesty and humility, Judaism embraces “chutzpah”, which is the opposite of humility.

When my son was younger, I enrolled him in Mensa as a member for a few years and received lots of their literature. Eventually he quit as we both came to the same conclusion: the members don’t seem to do much other than obsess over their “giftedness” and whine about how hard it is to live among people of low or average IQ. I guess it shouldn’t be a surprise, it was founded by a Jew, Isaac Asimov. My son finds it incredibly repulsive when people think themselves gifted or highly intelligent. He eschews the gifted label.

Something tells me the transgenderism zealot in your high IQ society is a Jew.

There are two types of intelligence – fluid intelligence and crystalized intelligence. Fluid intelligence, often known as g or general intelligence, is the intelligence associated with learning math and science. Crystalized intelligence is associated with experience. Fluid intelligence peaks in your mid 20’s, while crystalized intelligence continues to grow as one ages. Hence the saying, wisdom grows with age.

Mathematician Terence Tao once said that if you don’t solve the hardest math problems by 25, chances are you’ll never solve them. Tao studied calculus at age 9, received a gold medal at the International Math Olympiad at age 13 (youngest ever) and got his PhD from Princeton at 21. He is currently teaching at UCLA. When he received the Fields medal, he was incredibly humbled by it and said he did not do enough to deserve it. When a group of Silicon Valley billionaires gave him one of their annual $3M awards for being a distinguished mathematician/scientist, he was too embarrassed to receive it and said he hadn’t done anything to deserve such an award.

Exceptionally intelligent people tend to be very humble about their intelligence — unless they are Jewish.

Hi James,

In his book on Jewish intelligence, Richard Lynn mentions in passing that the average IQ in Glasgow is about 92. My question to you is this: has there been more work done on the breakdown of average IQ in the UK by region or major city? It struck me as quite significant. I guess the other question would be this: What about average IQ over time? For example, what was the average IQ of the original Pilgrims, the guys who settled America and built Harvard College, who I believe were from the southeast region of England?

Wrong when it comes to most people in the USA with a $1 Million net worth.

Statistics?

I have never seen you as an envious person, and I was bemused to see you so accused. A misapprehension of astonishing proportions.

Exercise can burn meaningful calories without going overboard.

And since muscle burns more calories than fat does, building muscle can help reduce fat even after the exercise is done, when sedentary.

Good Points. Except as to very high-earning athletes. There are so extremely few, compared to the general population of workforce,!that their number makes no difference and does not undermine the intelligence-income/wealth correlation in modern society.

At the end of the Milky Way you’d be ca. 200 ooo lightyears from home. And that’d be “very lonely” (Jagger/Richards – Two Thousand Light Years From Home), wouldn’t it? – So – – – what about this stuff is so hard to grasp that one would want to study theoretical physics to be able to “git” (M. Jagger) it?

Yes. And she said she made the same waiting room-observations.

As for the tests, the child psychiatrist would use a “fitting” test with 3-d objects and a cube with matching holes. – Big difference was: Kids who don’t get what’s up or are so impatient, that they don’t really try to find matching objects – and the others.

She just told me that she found your post ab so interesting, that she discussed it with her colleagues today in a short break at noon.

What do you make of the part of the preamble to the US Constitution that says the government is being formed to “promote the general welfare of the people?” In your estimation should the US government do nothing to help the welfare of its citizens?

Re:

How IQ of this or that variety changes with age is something about which I know nothing. However, it has frequently been proved the case that the elderly are highly effective leaders. Domenico Michiel, for example, the blind, 94-year-old Venetian Doge who personally led the Fourth Crusade to a brilliant victory over Byzantium. Then there was the Russian, Prince Kutuzov who, in the last year of his life, destroyed Napoleon’s army of invasion. And, and and and so many others.

You seem to think that Darwinian fitness, having children and all that, is somehow better than being a super high IQ investor driving a Tesla, owning a yacht, and living like a Sultan in a ten thousand square yard mansion. What an outlandish view.

Actually, my point about high-earning athletes is that they have a very high capacity for acquiring and using relevant information, such as where the other guys are on the football field and how to develop a productive movement. Their financial success thus conforms with the idea that intelligence, in this case, visual/spatial and kinaesthetic intelligence, can underlie success in gaining income and wealth.

How bright do you have to be to save X amount monthly and stipulate that the interest/dividend generated be reinvested? The power of compounding will make you comfortable in 20 years. Only discipline required is to live on what you earn and not touch the stock or bond fund or whatever.

When Taleb decided to expose the fraud of IQ, and especially the supposed correlation between IQ and income, he was backed up by fellow mathematicians. People like Stefan Molyneux (humanities major?) and other social science types tried taking on Taleb and defend the pseudoscience of psychology and “race realism”. It quickly turned to a mopping operation by Taleb. The IQ fetishists fled like rats, and like ISIS, they have simply licked their wounds and regrouped. It’s pathetic.

Fortunately I have been happy to live with that [first par] perhaps slightly delusional belief for decades which is a good thing because I lie down using a smartphone too much of the day and bursts on an exercise bike watching documentaries and at resistance exercises I hope make up for not getting near a swimming pool most of the year and relying mostly on tennis since I ran my one and only marathon at the same age as my father had his first heart attack. 4hrs 5min since you ask, but I was born to be a sprinter’s sprinter: out of breath 200 yards into a 220….

Y’know, I’ve never understood the importance given between the correlation of ‘wealth’ and IQ. It used to be an even vaguer ‘success’ associated with high IQ, but I was always given to understand that by ‘success’ they ultimately meant ‘wealth’ anyway.

I have a higher than average IQ (especially for a girl) and I have always excelled at anything I applied myself to. Yet beyond basic survival I couldn’t care less about money. And I’d rather live in a cave than anywhere near a city, where the vast majority of the high-income jobs are. Couldn’t care less for smart phones or fancy new cars or snazzy houses or any of that crap. And so on. Am I ‘successful’, though? By my standards, absolutely! (And yes I have money saved for emergencies and retirement.) But by the ‘success equals wealth’ crowd, I’m not at all, simply because I value different things, with no credence at all given to my own measure of happiness.

I’m not trying to argue with the article here, just pointing out there’s a whole different world with both high and low IQ folk that is largely ignored. Not all of us want gobs of money. Especially not this worthless, devalued fiat currency. I don’t know. Just always puzzled me.

Yeah…Terrence tao is from where I am from…Hong Kong…but he studied in Australia.

I haven’t met him but I have met some pretty impressive math guys in my life,

Anyway…

The IQ of interest here is G…fluid intelligence.

No idea what you babble on here.

My point is simply, there is a scam fiat “money” system, in fact a slave system.

The other point is, the US Americans have a pretty crazy idea, that everything is about money and that everything can be bought.

Intelligence has nothing to do with earning in a fiat scam system, that is self destructive.

Nothing justifies an multimillion income for a freaking useless manager or some CEO, well paid criminals in suits, whereas a simple fireman or nurse earns nothing but indeed contributes to society.

Everyone participating in the fiat system is basically contributing to his own destruction, and the day when they pull the plug from this system is near.

A wage is a fiat system is just more IOU promises, backed by nothing but thin air.

Your labour is the value, not the assigned fiat number

Mild emphasis edit: It’s not “my” high IQ society. Realtalk(tm) gets one booted from it by the snowflakes.

As for Asimov, I look to the son as a comment on the father.

Yes, and all men are created equal, too.

Poetry generally produces evil and misery when placed into a political context. No doubt you’d find just as much flowery idealism in the founding documents of Mao’s China, Lenin’s USSR and Pol Pot’s Cambodia.

If I told you my goal was X but I consistently produced Y, at what point would you realize that producing X was either impossible or that I had lied to you in the first place? Political documents, including both the Declaration of Independence (which was historical BS as evidenced by contemporaneous analysis in the “Strictures”) and the Constitution of 1787 (which was an open coup d’eta against the Articles of Confederation for which colonists fought) are fully of naked sophistry.

Newspeak didn’t begin with Nineteen Eighty-Four.

You were lucky not to be brought up to be either competitive by the Tiger or Jewish mother style of indoctrination or with a duty to change the world. So you can enjoy the privilege of the superior intellect cruising – lazily as some would put it – and, while avoiding poverty and misfortune thanks in good part to your wits, enjoying life by using your brain in at least many of its possibilities. Do you get pleasure out of reading books like Stephen Hawking’s and Leonard Mlodinov’s “The Grand Design”? Sad for those whose IQs don’t allow them that sort of pleasure.

Have you seen Steve Sailer’s stuff – years back – on the IQs of footballers playing in different positions? I know practically nothing about American football but think I remember quarterbacks had to be smart.

I take it you are not expecting to earn a living writing up or teaching your economic views. Enjoy your freedom to kick the ball all over the park and disturb no one.

Returning to the origin:

As you correctly observed, I used the word “just” quite purposely.

If I had written my statement without the “just” (which you state is “wrong”) your criticism would make sense.

I said “just” as a means of expressing the fact that wealth and income are NOT exclusively luck. You turned that on its head, suggesting that my statement indicates belief that wealth and income are exclusively a product of not-luck (intelligence, for instance.)

What was your reasoning here? Why did you attempt to twist what I said into something you could deride? Given my statement as an attack on rationalizing envy, your ham-handed reframe looks like a defense of envy. I stand by my observation that doing so suggests you are envious.

As to my being a cretin, perhaps so…but this cretin appears to have a 2-sd communication gap with you, and odds do not favor it being in your favor. PS: In this Age of Sophistry, I loathe sophists.

If you want to part with any of your “worthless, devalued currency,” I’m sure I can give you my address so I can take it off your hands.

I am an ant, riding on a leaf that floats down a wide river. The course of the river ahead is set, and what I desire has zero effect on it. I can see but a tiny bit of the river ahead, and while I may paddle madly to move toward one side or the other, it’s entirely possible that beyond my view are rapids or falls I’ve paddled into by accident.

Human history is one absurd fad after another. The only cooperation humans perform is spontaneous; both markets and herding behavior (fads & fashions) emanate from human cognition operating at a pre-conscious level. 100 years ago every right thinking person believed in eugenics. Today “everyone knows” it’s unconscionably evil to so believe. This is but one among many examples of how certain we all become about the timelessness of long-lived fads which happen to surround us.

My primary characterization of this Age is that it’s the Age of Passions. People feel so freed from concerns about survival that their impulsive mind runs amok with one Passion after another. Save the whales, stop climate change, free love, gay marriage, Go-grrrl-Power, magic dirt, blank slate, the list goes on and on.

My preference is to resist that Mr. Hyde, the source of my own passions.

YMMV.

Of course someone is going to get to what’s left over. That’s precisely the idea. What is left over can be redistributed equitably, rather than all of it going to your heirs.

In neither case is that wealth “earned” by its recipients; only, one distribution is rather obviously more equitable than the other.

Yes, that’s why I prefer taxing income as it’s earned, rather than waiting until a person dies to tax their estate – much harder to evade.

You asked me in another post why I’m so “envious.” I’m not surprised you’d ask that, as it’s about the only response a libertarian could make that sounds remotely appealing to anyone’s moral sensibilities. The answer is that I’m not; I just want to tax you (and me – I don’t get off the hook) in order to create a more equal society, which I think is a more pleasant society. It’s really not rocket science.

You know, I really fail to see how a reduction in earnings from 100x the median wage to “only,” say, 30x the median wage would make it hardly worth getting up in the morning. You still get to live materially far, far better than most people could ever dream of, so like, what’s the big deal here? What exactly are billionaires so worried about? You’re not a billionaire? You only earn, say, twice or three times the median? If that’s reduced to one-and-a-half to two times the median, I don’t see how that’s the end of the world either.

If IQ matters in life, and IQ trends are dysgenic, then the only thing that could make them eugenic is some kind of eugenics program. Only a eugenics program premised on creating a more equal society has even a whiff of chance of gaining traction. And that is going to cost money – you can guess where that is going to come from.

It does not seem surprising if quarterbacks are smart, although whether the kind of dynamic visuo-spatial intelligence that a good QB requires is measured by an IQ test, I’d rather doubt.

The best athlete I ever knew was the son of a surgeon. He had superb hand–eye coordination and could dissect out the nerves of a dogfish in minutes as the rest of us messed up the assignment in the course of several hours. But otherwise, his classroom performance was abysmal.

Equality of what?

Talent?

Health?

Wealth?

Opportunity?

Height?

Attractiveness?

Propensity to disease?

Size of house?

Number of recreational vehicles?

You use the term but clearly don’t realize that (1) some things cannot be made equal and (2) different concepts of equality are mutually incompatible. There’s a book that might be illuminating: “Equality, the Impossible Quest” by Martin Creveld.

I find the prospect of a more pleasant society equally attractive. (wink)

The difference is, I don’t think socializing such things has proved effective at producing one. I categorize your position as parallel to the disillusioned communists who wrote, “The God that Failed.” (Communism’s great, it’s just not yet been done correctly.)

I’m not concerned. I believe the era of these behemoth nation-states is over, and that the future will be a break-up into ever-smaller social/political entities. Some of those entities may embrace your “spread the wealth” policies, others may be less inclined to do so. Ideally, people will vote with their feet as to which to choose. Then again, this is pretty idealistic. But I’d rather that than discovering the current fictional Zombie Apocalypse mania is art foreshadowing reality.

Imagine a community where the absence of vast-scale anonymity prevents Able from gaming the local politics in order to obtain 100x the median production/wealth of others. In the same community, Benjamin (who is the most productive of all members) isn’t forced to pay the way of those who choose to be unproductive. It’s a small community by today’s standards, so the truth of these conclusions is fairly self-evident, not the product of some clown in a news organization presenting his own self-serving fiction.

This sounds a lot more pleasant than a nation-state of 300,000,000 people where leftists want to rob the “rich” but end up eating the working wealthy (higher income, but lower total wealth than the Pritzgers, the Buffets, etc.) and when there aren’t enough of THEM, the leftists start eating the hard-working middle class.

Today in America about half the country pays no income tax. The top 20% (which includes pretty much the entire Middle Class) pays something like 95-98% of income tax. The super rich, who have transcendent levels of wealth but often little reportable income, pay relatively little income tax.

Yet you like to tax income, spread “the wealth.” You don’t seem to notice that dynastic wealth seems to somehow escape the tax man no matter who seems to write the tax laws….instead, we see farmers who can’t leave their farm to the kids, or entrepreneurs whose businesses must be sold in order to satisfy death-transfer taxes (obviously, easily liquidated wealth can side-step Mr. Taxman without much difficulty.)

When will “taxing the productive” reach the optimal level? When a family with the capacity to earn $200k/yr is stripped of half that, so it can peacefully be given to their neighbor who sits on his ass on SSDI? Logic dictates that taxes are a disincentive to produce.

Like I said, these questions will be mooted soon enough. If those who PAY the taxes had to actually be taxed at the levels governments currently spend (AKA no borrowing) the entire game would be over. And it will be. No tree grows to the sky.

Nature runs the original and permanent eugenics program (I ignore for the moment that Nature’s program is not teleological.) It is the only one that will be chosen. If you think a deliberative body of people will choose something in this category, then I have a bridge to sell you. Or I can wait until you finish high school.

Today we exist in Plenitude. People behave (and clearly believe) as though resources are permanently unlimited. Somehow no one seems to notice that Modern Prosperity is all going on the Collective MasterCard. I guess no one grasps that when a family begins to put all their bills on plastic it’s a signal of impending (ahem) status change. What makes an axiom of Nature axiomatic is that it applies at all degrees of scale.

We’re living in an antebellum Golden Age despite the collective insanity and stupidity extant. History hasn’t been repealed, and the fractal of human social experience shows that the higher the rise, the bigger the fall. I have no idea what tools Nature will employ when Nature’s culling of humanity resumes after a hiatus (waterborne disease is a favorite, but crop failures and famine…both natural and man-made, are useful, too.) But I suspect that current UN population estimates for the next century will prove to be the subject of black humor for a very long time.

Whatever Nature’s program, I seriously doubt “more equality” will be its product (unless you count the equality of life among the dead.) I’m rather counting on “better smarts” being a survival tool, but nothing is ever guaranteed. Many (most?) of the greatest minds from two thousand years ago have no living descendants.

Lynn has data on regional differences across the world, so this is a bigger subject than I can cover in this answer. Again, for average IQ over time, start by putting “Flynn effect” in my search bar. Good questions, both of them, but the replies will be on the very long side.

Pleased to hear it. My regards to her.

Excellent point. We are just an off shore establishment of European civilization and since the Romans, there’s always been the general welfare component of western civilization.

Our religious culture, Christianity provides for the general welfare. Islam and Judaism provides for the general welfare. Atheists still belong to the religious culture of their civilization.

Building roads bridges and canals to promote trade and so farmers can get food to the nearby towns promotes the general welfare.

Creating caravanasires in Central Asia networks of castles and monasteries in Europe or the American highway system with regular rest stops and gas stations is for travelers is for the general welfare.

Living wages would make the phenomenon of families with working parents getting food stamps and government subsidized housing unnecessary.

General good and welfare is a lot more than 4 generations of 300 pound black women popping out a new generation of black criminals every 20 years. General good and welfare today demands we end the policy of paying black women to produce criminals. Short simple procedures at black births would solve the problem

What interest? Have you looked at your bank statements or the CD rate signs at your bank lately? My highest is . 35. But 2 of my banks don’t charge monthly or any other fees. So I’m not ripped off for the monthly fees. Nothing but $10 for new checks every few years.

$15 or $20 monthly fees wipe out the old $3.00 monthly interest we used to get. Because of extremely low interest rates bank accounts are just a convenience for direct deposit, paying bills on line or checks and making purchases with debit cards. Checks have to be processed and ATMs have to be stocked by paid employees. But debit cards and on line payments don’t cost banks salaries.

At least we don’t have to pay income tax on bank account interest anymore because there isn’t any bank account interest anymore.

Soon the banks will charge us for the privilege of having a bank account as we’ charged for renting their safe deposit boxes.

And what’s $20.00 monthly fees but a negative interest charge, especially as so many people pay bills on line instead of with checks anymore.?