gallon of milk 48 cents loaf of bread 8 cents dozen eggs 36 cents 2 postage stamps 3 cents gallon of gasoline 19 cents minimum wage 30 cents an hour New car $680 New home $3,850 Average income $2,163 Dow Average 134 The price of gold $35 per ounce Price of gold today $2,038 per...

Read MoreA clip from the 1990 movie Home Alone where the lead character purchases groceries, household goods, and toys recently went viral because he paid a total of $19.83 whereas today the same purchase would cost over three times as much. Ironically, while this evidence of the Federal Reserve’s failure to maintain the dollar’s value was...

Read MoreFed Chair, Jerome Powell, is considering a pause in rate hikes, and then three rate cuts in 2024. In response to talks of a pivot, the Dow soared to near all-time highs, with overall market sentiment hyper bullish. However, yesterday stocks plummeted like last week never happened. We are still hearing the same propaganda about...

Read More

Or Does It Live on Like a Zombie?

RADHIKA DESAI: Hello and welcome to the 20th Geopolitical Economy Hour, the show that examines the fast-changing political and geopolitical economy of our time. I’m Radhika Desai. MICHAEL HUDSON: And I’m Michael Hudson. RADHIKA DESAI: Well, it’s happening again. Reports of the death of neoliberalism are once again proliferating. Just take a look at the...

Read MoreRon Paul • December 11, 2023 • 600 Words

President Biden recently repeated the claim that high prices are caused by greedy businesses. Biden is not alone in trying to gaslight the people into thinking price inflation is rooted in the actions of private individuals and not the fiat money system Americans have lived under since 1971. In the media we see excessive consumer...

Read More

The Hidden History of How the U.S. Was Used to Create Israel

As the crisis involving the Israelis and Palestinians deepens after the October 7 Hamas attack, we might pause to examine how the state of Israel was created in the first place. At the current juncture, as World War III looms on the horizon, as massacres are currently being perpetrated by Israel against the civilian population...

Read MoreWho now controls inflation in the U.S.: A trapped Fed, or the new commodity king?

A quiet ‘watershed’ moment has passed. It was nothing ‘splashy’; many perhaps barely noticed; yet significant it truly was. The G20 did not descend into the expected sordid confrontation, with the G7 states (which Jake Sullivan has called the ‘steering committee of the free world’) demanding explicit condemnation of Russia over Ukraine, versus the Rest...

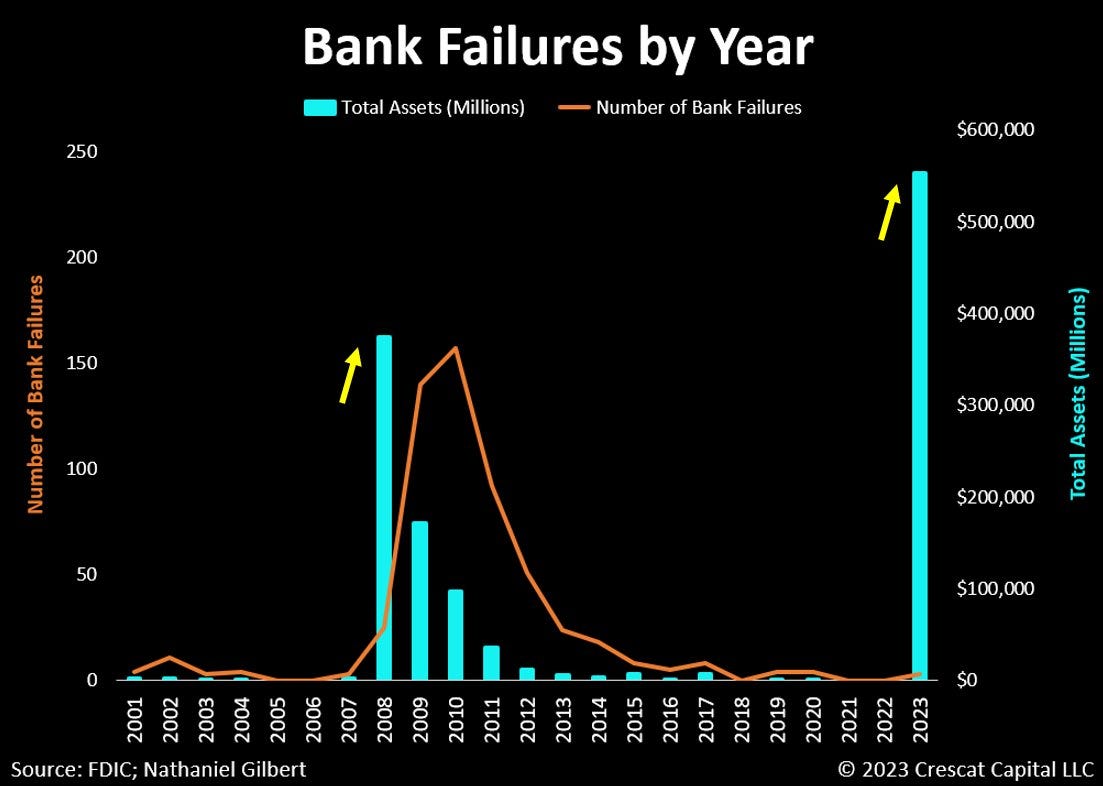

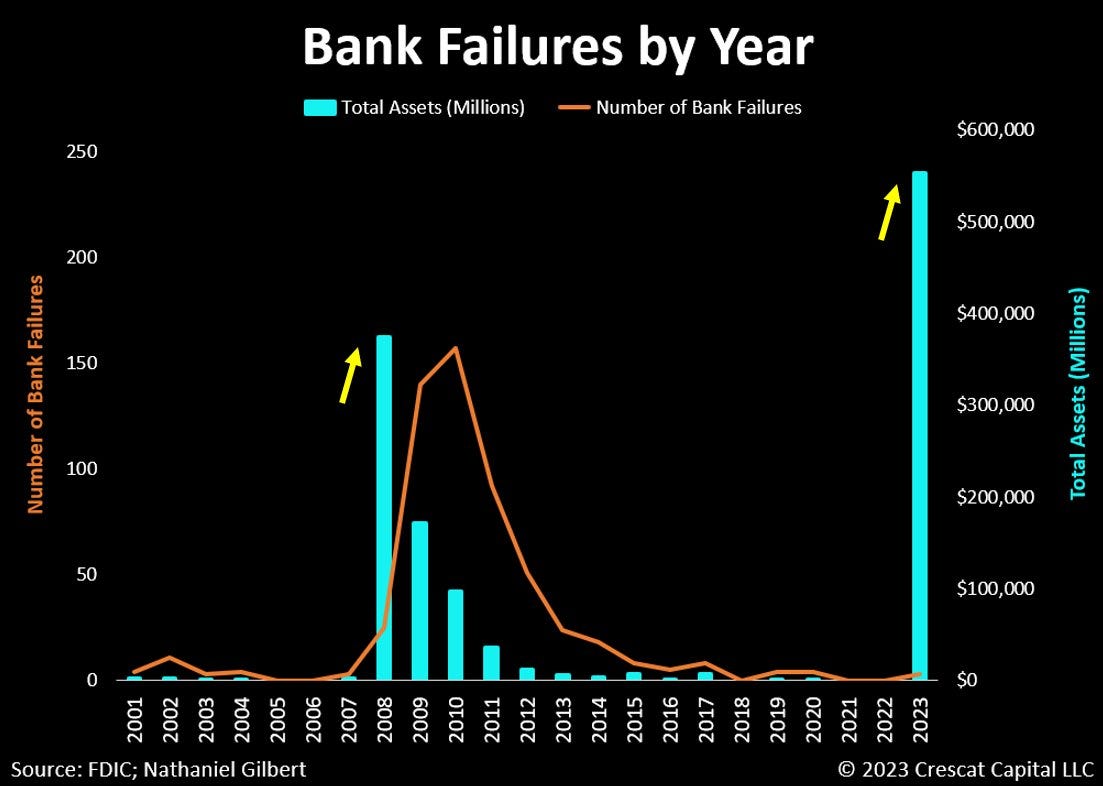

Read MoreU.S. banks are again in the crosshairs. Standard and Poor’s has downgraded five new middle-tier banks and put three others on negative outlook. This follows sweeping downgrades earlier in August by Moody’s, which cut credit ratings on 10 banks and placed four of the 15 largest U.S. banks on review for possible downgrade. As with...

Read More

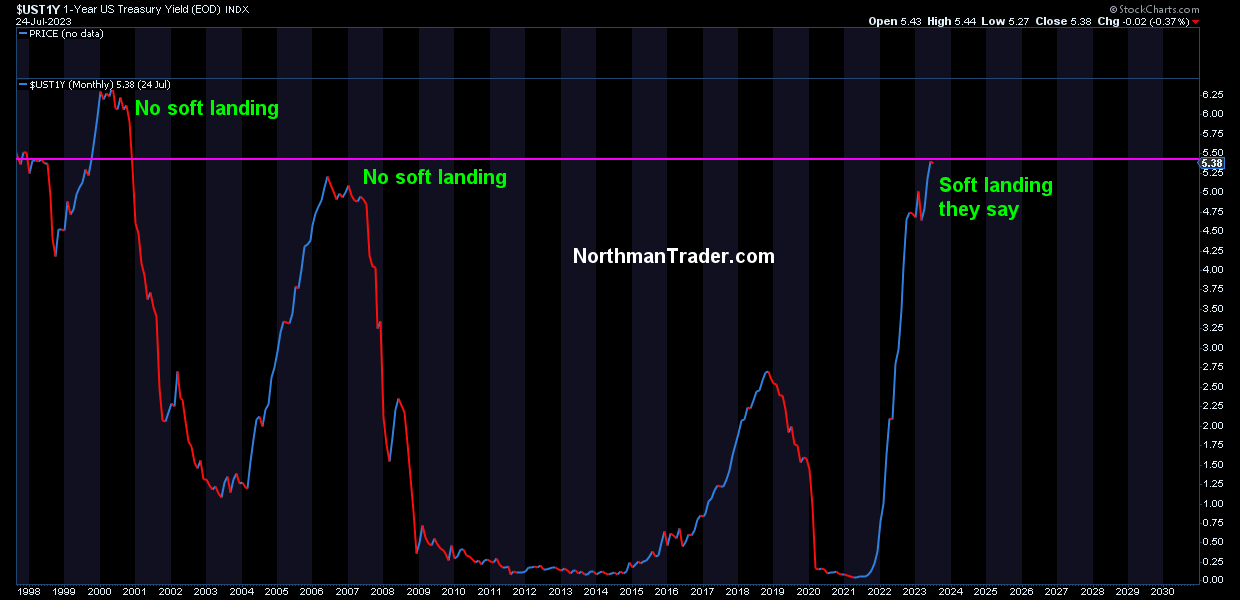

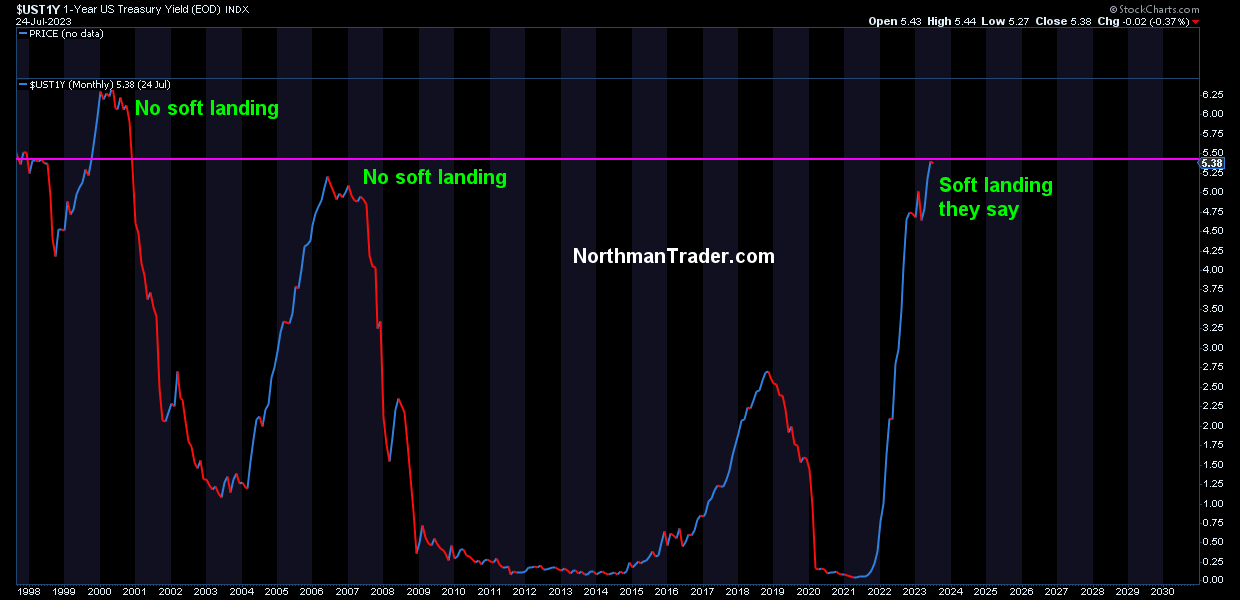

Market sentiment has gotten much more bullish since when I wrote No Collapse is the Real Dystopia in June. This summer saw a major bull market, or rather bear market rally, with the Dow reaching its longest winning streak since the 1980s. The “top economists” did a total U-turn and no longer expect a recession...

Read MoreEarly in 2017, Senator Chuck Schumer stated that then-newly elected President Donald Trump was dumb to be antagonizing the intelligence community because “they have six ways from Sunday to get back at you.” Senator Schumer seems to have been onto something, given the possible involvement of US national security officials in the various attempts to...

Read More

This originally appeared as “Obscuring the Jewish Issue in Media #2 - Banking Dynasties” on The Occidental Observer in October 2022. It so starkly revealed the origins of Jewish power over the U.S. starting in 1913 and expanding to today, that I felt it needed to be re-written outside that essay series focused on media,...

Read MoreDeficit spending is when government overspends its revenues and issues Treasury bills/bonds to borrow the money to fill the gap. If the debt instruments cannot be sold at the interest rate the Fed is maintaining, the Fed buys the bonds. The US dollar being world currency means that foreign central banks are content to hold...

Read MoreLike all indoctrinated economics PhDs, I used to teach students that the Federal Reserve was created as a central bank in order to provide cash to banks experiencing a run on deposits so that bank failures would not become general and collapse the money supply and, thereby, employment and output. It all sounds so reasonable...

Read MoreHaha. RT: Hahahahahahaha. Asked by Congressman Vicente Gonzalez whether the US should lower the use of sanctions in its foreign policy given that even traditionally allied countries, such as France, have been making non-dollar transactions, Yellen stated that for most countries she sees “no meaningful workaround” to using the dollar. She acknowledged that there is...

Read More

For today’s episode, we want to talk about what’s going on in the US economy. Because when you look at the discussion that’s going on, you see a lot of contradictory narratives. On the one hand, you have people like Bank of America’s CEO Brian Moynihan, who said on Sunday that the country may face...

Read More

Still waiting for the Big Collapse

So far the 2020s seem more chaotic than previous decades. Based upon current events, economic and sociological data, and looking at historical cycles like the 4th turning theory and Peter Turchin’s research, it looks like there will be a major historical crisis this decade. In contrast, the 2010s felt very stagnant, despite the recession at...

Read MoreThere's a big dam on the Dnieper River that supplies all of the water to Crimea and they blow it up. Thousands of homes have been flooded. Naturally, the Ukrainians said the Russians did it. The reason that Crimea was assigned to Ukraine by Khrushchev in the 1960s was because the water and electricity area...

Read MoreAnother agenda is in play

Dear readers and fellow economists, the Federal Reserve is treating a rise in prices from supply shocks and disruptions from the Covid lockdowns and sanctions against Russia, Iran, and other countries as if it were a monetary inflation. It is true that too much money is chasing too few goods and services, but the cause...

Read More

Prof. Michael Hudson’s new book, The Collapse of Antiquity: Greece and Rome as Civilization’s Oligarchic Turning Point is a seminal event in this Year of Living Dangerously when, to paraphrase Gramsci, the old geopolitical and geoeconomic order is dying and the new one is being born at breakneck speed. Prof. Hudson’s main thesis is absolutely...

Read More

On Fox Business, Shark Tank’s Kevin O’Leary touted North Dakota’s remarkable pro-growth environment with the Nation’s fastest growing GDP per capita. While O’Leary praised North Dakota for its pro-business policies and oil and energy production, he also praised the State for its sovereign public bank, which may seem antithetical for a Reaganite Conservative. Kevin O’Leary...

Read More

BEN NORTON: Hi, everyone. I’m Ben Norton, and this is Geopolitical Economy Report. Today, I have the pleasure of being joined by Michael Hudson, the brilliant economist and author of many books. Michael is also the co-host of a program here, Geopolitical Economy Hour, that he does every two weeks with friend of the show...

Read MoreAs I reported at the time, the banking crisis is not limited to Silicon Valley Bank. Silicon Valley Bank’s failure was followed by the failures of New York Signature Bank and First Republic Bank of San Francisco. Now three more banks have had their stock prices collapse–Western Alliance, PacWest Bankcorp, and Metropolitan Bank. As I...

Read MoreThis is the problem. I keep saying it’s the problem. These countries are now starting to trade in non-dollar currencies, after the US was universally determined – by 85% of the world’s population, by the way – to be a mad dog that can no longer be expected to uphold the global financial system. However,...

Read MoreUS power since World War II has been based on its financial dominance stemming from the dollar being the reserve currency held by central banks in place of gold. As the dollar was the currency used to settle international trade accounts, every country needed dollars. That ensured a large demand for dollars to absorb the...

Read More

According to an article in American Banker titled “SEC’s Gensler Directly Links Crypto and Bank Failures,” SEC Chair Gary Gensler has asked for more financial resources to police the crypto market. Gensler testified at an April 18 House Financial Services Committee hearing: [Crypto companies] have chosen to be noncompliant and not provide investors with confidence...

Read More RSS

RSS